| 🏛️ Based in | Limassol, Cyprus |

|---|---|

| ⚖️ Regulation | FSCA |

| 💰 Minimum Deposit | $250 (100000 Naira) |

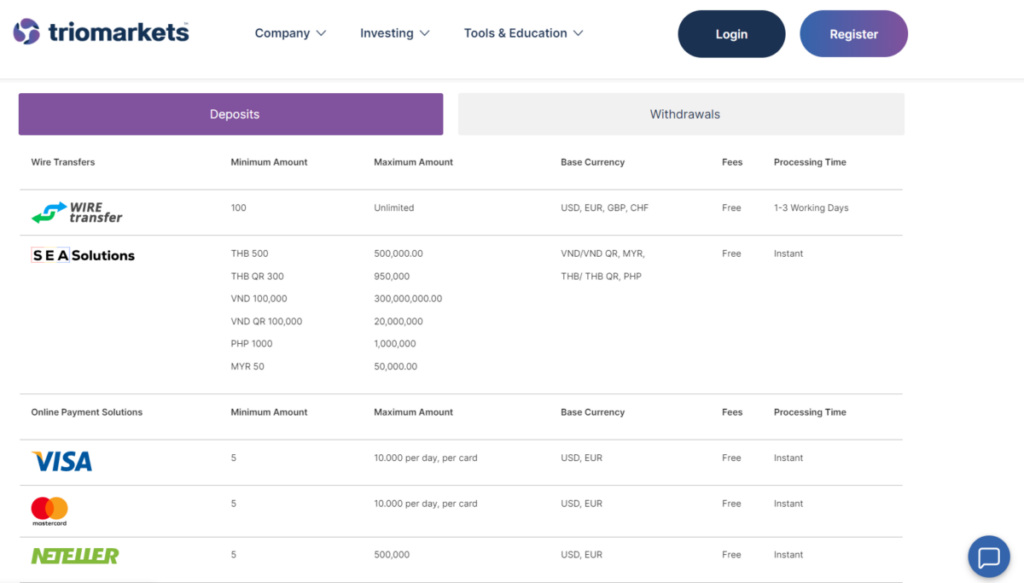

| 💳 Deposit Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 💳 Withdrawal Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 📌Open an account | Start Trading with TrioMarkets |

Contents

- 1 Regulation and Security

- 2 Is TrioMarkets Legit or a Scam?

- 3 TrioMarkets Trading Instruments

- 4 TrioMarkets Accounts

- 5 Trading Tools

- 6 Leverage, Spreads and Commissions

- 7 Deposits and Withdrawals

- 8 Account Registration

- 9 Bonuses and Promotions

- 10 Trading Platforms

- 11 Education and Research

- 12 Customer Support

- 13 Our Verdict

- 14 FAQs

- 15 Similar Brokers

Our Opinion on TrioMarkets

When it comes to forex trading in Africa, TrioMarkets stands out from the crowd. This innovative broker, founded in 2014 and headquartered in Cyprus, has been making waves in the industry with its unparalleled trading conditions, cutting-edge technology, and unwavering commitment to client satisfaction. African traders looking for a reliable, trustworthy, and efficient broker need look no further than TrioMarkets.

Regulation and Security

When it comes to the safety of your funds and the integrity of your trades, TrioMarkets leaves no stone unturned. The broker’s parent company, Benor Capital Ltd, is authorized and regulated by Mauritius’s Financial Services Commission (FSC) (license number C118023678), ensuring a level of oversight that resonates with African traders.

Furthermore, TrioMarkets’ European arm, EDR Financial Ltd, is a Cyprus Investment Firm (CIF) regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 268/15. This means the broker adheres to stringent European regulatory standards, offering clients additional protection and peace of mind.

Is TrioMarkets Legit or a Scam?

With its impressive track record, transparent operations, and glowing client reviews, TrioMarkets has established itself as a legitimate and trustworthy broker in the African trading community. The company’s commitment to client safety is evident in its use of segregated funds, negative balance protection, and partnerships with top-tier banks. While no investment is entirely risk-free, trading with a reputable broker like TrioMarkets significantly reduces the chances of being a victim of fraudulent activities.

TrioMarkets Trading Instruments

TrioMarkets offers an extensive range of trading instruments, catering to the diverse needs and preferences of African traders:

- 60+ forex pairs

- Spot metals

- Energy CFDs

- Stock index CFDs

- Share CFDs

- Cryptocurrency CFDs

The broker’s competitive spreads and advanced execution technology make it an attractive choice for traders looking to maximize their profits and minimize their costs.

TrioMarkets Accounts

Understanding that no two traders are alike, TrioMarkets offers a range of account types tailored to suit different trading styles and budgets:

| Type | Spreads | Min. Deposit | Max. Leverage | Commission |

|---|---|---|---|---|

| Basic | From 2.4 pips | $100 | 1:500 | $0 |

| Standard | From 1.4 pips | $5,000 | 1:500 | $0 |

| Premium | From 1.1 pips | $25,000 | 1:500 | $0 |

| VIP | From 0.0 pips | $50,000 | 1:500 | $4 per lot |

Basic Account

This is the best account option for new traders in Africa. It comes with an average spread of 2.4 pips and there are no commissions. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $100 and the base currency is USD. It is worth noting that the Basic Account is only available on MT4.

Standard Account

This is a good account option for intermediate forex traders in Africa. It comes with an average spread of 1.4 pips and there are no commissions. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $5000 and the base currency is USD. It is worth noting that the Standard Account is only available on MT4.

Advanced Account

This is a good account for African traders with more experience. It comes with an average spread of 1.1 pips and there are no commissions. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $25,000 and the base currency is USD. As with the other accounts, it is worth noting that the Advanced Account is only available on MT4.

Premium Account

This is a great account for professional traders in Africa. It comes with an average spread of 0.0 pips and there is a $4 commission per side. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $50,000 and the base currency is USD. As with the other accounts, it is worth noting that the Advanced Account is only available on MT4.

Islamic swap-free accounts are also available upon request. The range of options allows African traders to choose an account that best suits their needs and budget. While minimum deposits are higher than some brokers, the tight spreads and high leverage available help provide good overall value.

Trading Tools

TrioMarkets equips its clients with a powerful suite of trading tools designed to enhance their market analysis. Here is a list to help boost their trading performance;

- Advanced charting tools in MetaTrader 4

- Free VPS services for qualifying accounts

- Trading signals from in-house analysts

- Regular market insights

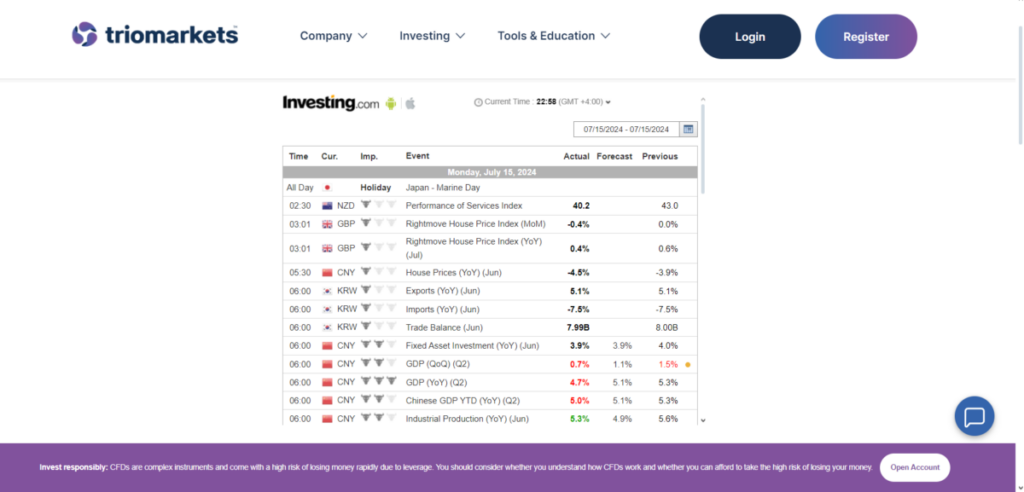

- Economic calendar

- Powerful suite of trading tools for market analysis

- Tools to boost trading performance

These tools and features are designed to help traders succeed by providing them with comprehensive market information and analysis capabilities.

Leverage, Spreads and Commissions

TrioMarkets offers flexible leverage options up to 1:500, allowing African traders to maximize their market exposure while managing risk. The broker’s ultra-competitive spreads, particularly on Premium and VIP accounts, can help traders keep more of their profits.

For those who prefer raw spreads, the’ VIP account offers spreads starting from 0.0 pips, with a reasonable commission of just $4 per round turn standard lot. With transparent pricing and no hidden fees, traders can operate with confidence, knowing exactly what they’re paying for.

Deposits and Withdrawals

Funding a TrioMarkets account is a breeze, thanks to the broker’s support for a wide range of payment methods. These include bank wire transfers, credit/debit cards, e-wallets like Skrill and Neteller, and even cryptocurrencies. Deposits are processed quickly and without fees from TrioMarkets’ end, although payment providers may charge a small fee.

Withdrawing funds is equally straightforward. Simply submit a request through the client portal, and TrioMarkets will process it within 24 hours on business days. While withdrawal fees may apply depending on the chosen method, the broker’s transparent fee structure ensures that traders always know what to expect.

Account Registration

Opening a live TrioMarkets account is a straightforward, fully digital process that can be completed in just a few easy steps:

- Go to the TrioMarkets website and click on the “Register” button.

- Complete the online registration form by providing your personal details.

- Verify your email address by clicking on the link sent to your registered email.

- Submit the required identity and residency documentation for account verification.

- Once your account is approved, make your initial deposit to fund your trading account.

As soon as your TrioMarkets live account is active and funded, you can download the MetaTrader 4 platform. Log in using your account credentials, and begin trading. If you’re new to forex trading or wish to test your strategies without risking real money, you can also open a demo account to practice trading in a risk-free environment.

Bonuses and Promotions

TrioMarkets offers an enticing array of bonuses and promotional offers designed to give African traders a competitive edge. There’s something for everyone, from welcome bonuses for new clients to loyalty programs that reward active traders.

The broker’s refer-a-friend program is also worth exploring. it allows traders to earn trading credits or cash rewards for introducing new clients to TrioMarkets. As with any promotional offer, it’s essential to read the terms and conditions carefully to understand the requirements for each offer.

Trading Platforms

TrioMarkets has partnered with MetaQuotes to bring African traders the world-renowned MetaTrader 4 (MT4) platform. This powerful, user-friendly software is packed with features designed to enhance the trading experience, including:

- Customizable interface

- Advanced charting tools

- One-click trading

- Expert Advisor (EA) compatibility

- Secure, encrypted communication

With MT4’s mobile apps for iOS and Android, traders can monitor positions, analyze markets, and place trades on the go. Plus, TrioMarkets offers additional tools that expand MT4’s capabilities, giving traders even more options for customizing their trading setup.

Education and Research

Whether new to forex or a seasoned trader looking to sharpen skills, TrioMarkets’ comprehensive educational resources have something to offer. The broker’s in-depth courses cover everything from the basics of forex trading to advanced strategies and market analysis techniques.

TrioMarkets hosts regular webinars, providing African traders valuable insights into current market conditions and trading opportunities. With a library of eBooks and daily video analysis, there’s never a shortage of educational content to help traders grow and succeed.

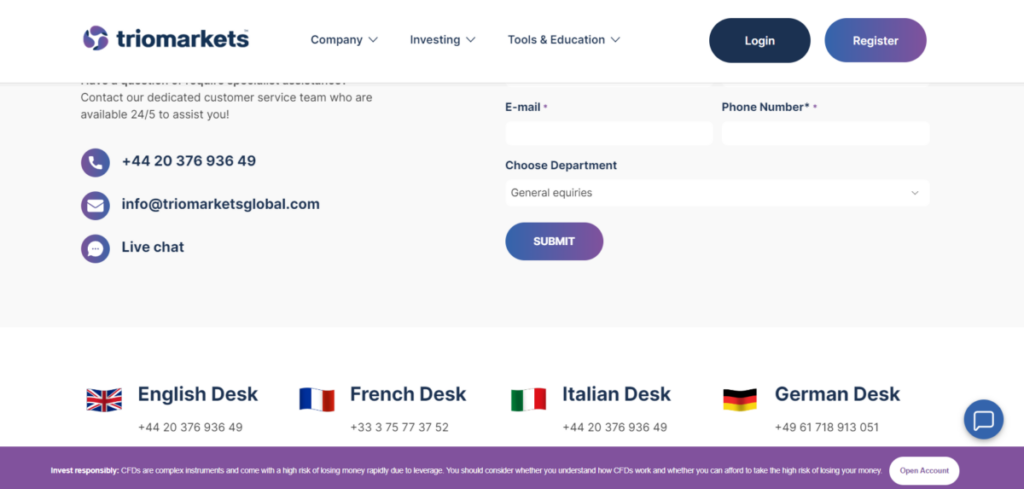

Customer Support

When trading with TrioMarkets, African traders are never alone. The broker’s dedicated customer support team is available 24/5 via live chat, phone, and email to assist with any questions or concerns.

TrioMarkets’ website is also a treasure trove of helpful information, with detailed FAQs, trading guides, and platform tutorials designed to help traders make the most of their experience. Support is available in multiple languages, so African traders can communicate with the broker in their preferred language.

Our Verdict

After an in-depth analysis of TrioMarkets’ offerings, it’s clear that this broker is a top choice for African traders. With its strong regulation, competitive trading conditions, advanced platforms, and commitment to client education and support, this broker ticks all the boxes.

While the broker’s minimum deposit requirements may be higher than some competitors, the value provided by TrioMarkets’ overall package more than justifies the cost. For African traders seeking a reliable, transparent, and efficient broker, TrioMarkets is a name you can trust.

FAQs

While TrioMarkets may not be directly regulated in all African countries, the broker’s license from Mauritius Financial Services Commission (FSC) provides a level of oversight that is particularly relevant to African traders.

Yes, TrioMarkets prioritizes client safety by keeping funds in segregated accounts at top-tier banks and offering negative balance protection.

TrioMarkets accounts are denominated in USD, EUR, GBP, and CHF. African traders will need to convert their local currency into one of these base currencies to fund their account.

Similar Brokers

Broker | |||||

Review | |||||

CopyTrading | |||||

Platforms |