With Sudan’s economy on the rise and a growing interest in financial markets, the forex trading landscape in Sudan is evolving. For Sudanese traders, the first and most crucial step into the dynamic and potentially lucrative forex market is choosing the right broker. This comprehensive guide will look into the forex trading environment in Sudan and spotlight some of the best brokers in Sudan.

Broker | Features | Broker Review | Visit |

* 1:1000 leverage * 1200+ instruments * $5 min. deposit * FSCA licence | |||

* 1:400 leverage * 1000+ instruments * $0 min. deposit * CMA licence | |||

* 1:2000 leverage * 250+ instruments * $50 min. deposit * CySEC licence | |||

* 1:888 leverage * 1000+ instruments * $5 min. deposit * CySEC licence | |||

* 1:500 leverage * 80+ instruments * $200 min. deposit * ASIC licence | |||

* 1:1000 leverage * 200+ instruments * $1 min. deposit * CySEC licence |

Contents

Understanding Forex Trading in Sudan

The Sudanese Forex Market

The forex market in Sudan is rapidly evolving, mirroring the country’s changing economic landscape. Despite financial challenges, many Sudanese citizens are turning to forex trading as a potential source of additional income or even as a primary occupation. This growing interest is partly due to the global accessibility of forex markets and the potential for profits in both rising and falling markets.

It’s crucial to emphasize that forex trading, while potentially lucrative, carries significant risks. It requires careful consideration, education, and risk management. The volatility of currency pairs, combined with leverage, can lead to substantial losses if not cautiously approached.

Regulatory Environment

Sudan’s forex trading regulatory environment is still in a developmental stage. The Central Bank of Sudan (CBOS) is the country’s primary financial regulator. Still, its oversight of forex brokers operating within Sudan is limited compared to that of more established financial markets.

This regulatory gap has led many Sudanese traders to opt for international brokers regulated by reputable foreign authorities. These include regulatory bodies such as:

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- Financial Sector Conduct Authority (FSCA) in South Africa

Choosing a broker regulated by one of these reputable authorities can provide additional security and peace of mind for Sudanese traders, instilling a sense of confidence in their trading decisions.

Critical Considerations for Sudanese Traders

When selecting the best brokers in Sudan, traders should carefully evaluate the following factors:

- Regulation and Security: Ensure a reputable authority regulates the broker and implements strong security measures to protect your funds and personal information.

- Trading Conditions: Look for competitive spreads, flexible leverage options, and a minimum deposit that aligns with your budget. Remember that while high leverage can amplify profits, it also increases potential losses.

- Available Trading Instruments: Consider whether the broker offers a wide range of currency pairs, including exotic pairs that might interest Sudanese traders. Some brokers also provide trading in other assets like commodities, indices, and cryptocurrencies.

- Trading Platforms and Tools: Evaluate the broker’s trading platforms, including their user-friendliness, available technical analysis tools, and mobile compatibility. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary platforms offered by some brokers.

- Customer Support: Reliable customer support, preferably in Arabic, can be crucial, especially for new traders. Look for brokers offering multiple support channels and 24/5 availability.

- Educational Resources: Brokers offering comprehensive educational materials (webinars, tutorials, e-books) can be particularly valuable for beginners and those looking to improve their trading skills.

- Payment Methods: Check if the broker supports payment methods accessible in Sudan, such as bank transfers or popular e-wallets.

- Islamic (Swap-free) Accounts: The availability of swap-free accounts is an important consideration for traders adhering to Islamic finance principles.

Best Brokers In Sudan

Let’s examine three of the best brokers available to Sudanese traders based on our analysis:

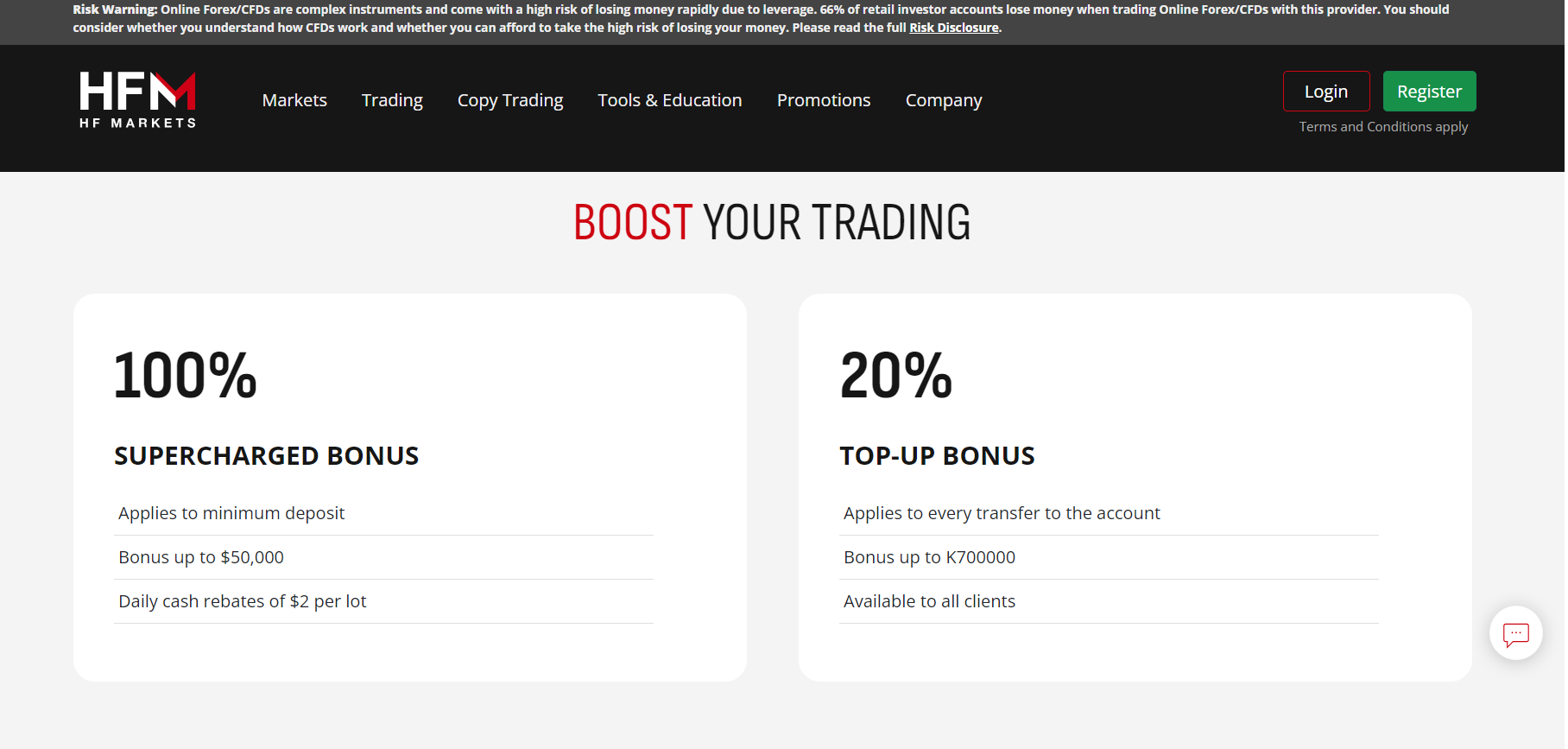

1. HFM

HFM is a well-established broker that caters to traders worldwide, including those in Sudan.

Key Features:

- Leverage: Up to 1:1000

- Number of Instruments: 1200+

- Minimum Deposit: $5

- Regulation: FSCA (Financial Sector Conduct Authority, South Africa)

| Pros😊 | Cons🤔 |

|---|---|

| Low minimum deposit ($5) | High leverage can be risky for inexperienced traders |

| Wide range of trading instruments Regulated by a reputable authority | Limited physical presence in Sudan |

| Regulated by a reputable authority | |

| Offers Islamic (swap-free) accounts | |

| Multiple account types | |

| Comprehensive educational resources |

HFM stands out for its low entry barrier and diverse range of trading instruments. The $5 minimum deposit makes it an attractive option for Sudanese traders who want to start with a small investment. The FSCA’s regulation of brokers provides additional security for traders.

HFM also offers a variety of account types, including micro accounts suitable for beginners and ECN accounts for more experienced traders. Their educational resources, including webinars and trading tutorials, can particularly benefit Sudanese traders looking to improve their skills.

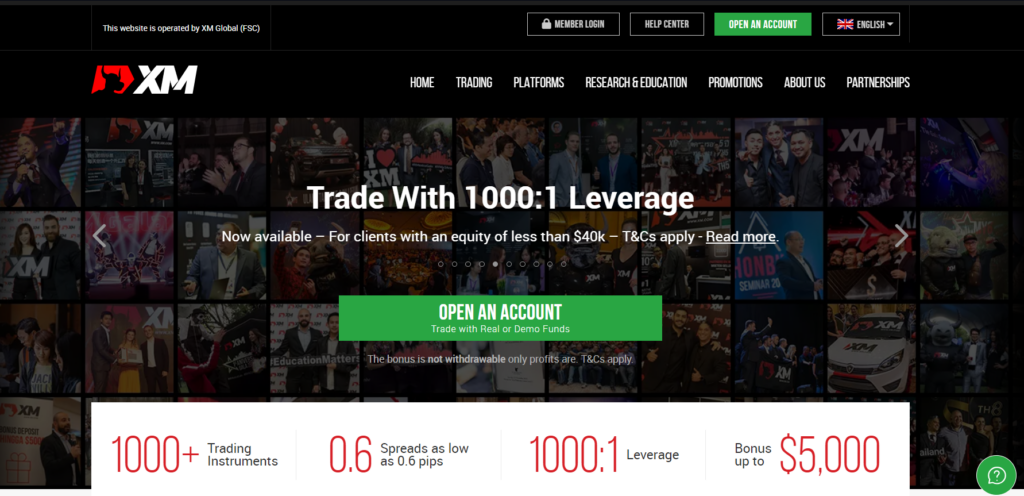

2. XM

XM is another popular choice among Sudanese traders. It is known for its robust trading conditions and educational resources.

Key Features:

- Leverage: Up to 1:888

- Number of Instruments: 1000+

- Minimum Deposit: $5

- Regulation: CySEC (Cyprus Securities and Exchange Commission)

| Pros😊 | Cons🤔 |

|---|---|

| Low minimum deposit ($5) | Inactivity fees may apply to dormant accounts |

| Extensive educational materials | Lower maximum leverage compared to some competitors |

| Multiple account types | |

| Regulated by a respected European authority | |

| Offers trading in multiple assets beyond forex | |

| User-friendly platforms with advanced tools |

XM’s strength lies in its comprehensive educational resources, which can benefit novice Sudanese traders. The broker offers webinars, video tutorials, and articles covering various aspects of forex trading. Its regulation by CySEC ensures compliance with strict European financial standards.

XM also provides a personal touch with its account managers and multilingual customer support, which can be reassuring for traders in Sudan who may prefer personalised assistance. The broker’s offering of MT4 and MT5 platforms gives traders flexibility in choosing their preferred trading environment.

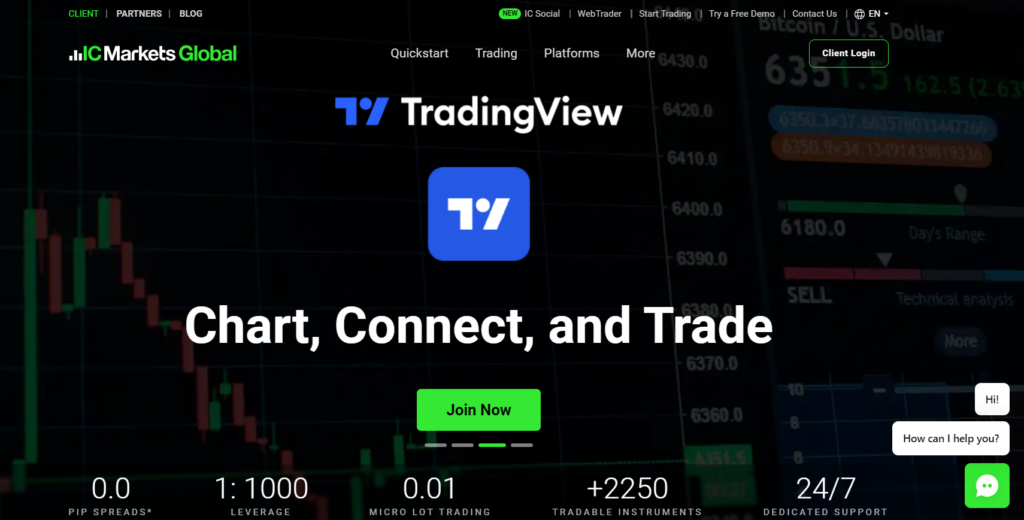

3. IC Markets

IC Markets is known for its focus on providing a superior trading environment, particularly for more experienced traders.

Key Features:

- Leverage: Up to 1:500

- Number of Instruments: 80+

- Minimum Deposit: $200

- Regulation: ASIC (Australian Securities and Investments Commission)

| Pros😊 | Cons🤔 |

|---|---|

| Advanced trading platforms | Fewer educational resources compared to some competitors |

| Suitable for both novice and experienced traders | Higher minimum deposit compared to other options |

| Regulated by a top-tier authority | |

| Competitive spreads and low commissions | |

| Offers social trading options | |

| High-quality trade execution |

IC Markets is an excellent choice for Sudanese traders who prioritise trading conditions and execution quality. While the minimum deposit is higher, the broker compensates with superior trading technology and a wide range of advanced tools. The ASIC regulation provides strong investor protection.

For more experienced Sudanese traders or those looking to advance their trading strategies, IC Markets offers features like VPS (Virtual Private Server) hosting and support for automated trading. Their raw spread accounts can be particularly attractive for high-volume traders looking to minimise trading costs.

Final Thoughts

The forex market offers exciting opportunities for Sudanese traders, but choosing a reputable and suitable broker is crucial. HFM, XM, and IC Markets all provide robust offerings for traders in Sudan, each with its strengths. You can find the best brokers in Sudan that best aligns with your trading goals and risk tolerance by carefully considering your needs and doing thorough research.

Remember, forex trading involves a substantial loss risk and is unsuitable for all investors. Continually educate yourself thoroughly about the risks involved and consider seeking advice from financial professionals before engaging in live trading. Start with a demo account to practice your strategies, and only invest money you can afford to lose.

#Protip: It is advisable to open demo accounts with multiple brokers to test their platforms and services before committing to real funds. This lets you experience the trading environment firsthand and determine which broker best suits your trading style and needs.