Forex trading is essentially the buying of one currency and the simultaneous selling of another. Therefore when trading currency pairs we will always see them quoted in pairs.

When placing a trade we are speculating on which currency we believe will become stronger or weaker against the other with the goal of making a profit from the exchange rate movement.

The currency to the left is called the base currency. The currency to the right is called the quote the currency. The quote currency tells us how much it is worth against 1 unit of the base currency. So if we say the EURUSD is trading at 1.3000 it means 1 euro equals $1.30.

The base currency is the basis for the buy or the sell trade. If we believe that the Euro will strengthen against the dollar we would buy the EURUSD pair. This means we are buying the base currency – the EURO, and simultaneously selling the quote currency – the US DOLLAR.

If we believe the EURO will weaken against the US Dollar we will sell the pair i.e. we are selling EURO and simultaneously buying US DOLLARS.

When we are buying the base currency, in traders jargon we call this going long (looking to profit from the pair rising), and when we are selling the base currency we call this going short (looking to profit from the currency pair falling).

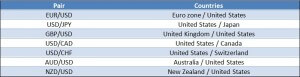

Major Currency Pairs

Major currency pairs all contain the US Dollar on one side – either on the base side or quote side. They are the most frequently traded pairs in the FOREX market. The majors generally have the lowest spread and are the most liquid. The EUR/USD is the most traded pair with a daily trade volume of nearly 30% of the entire FX market.

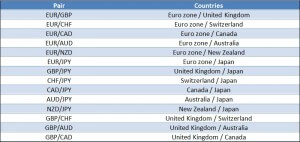

Cross-Currency Pairs or Minor Currency Pairs

Currency pairs that do not contain the US Dollar are known as cross-currency pairs or simply “crosses”. Historically, if we wanted to convert a currency, we would have had to first convert the currency into US dollars and then into the currency which we desired.

With the introduction of currency crosses we no longer have to do this tedious calculation as all brokers now offer the direct exchange rates. The most active crosses are derived from the three major non-US dollar currencies (the Euro, the UK Pound and Yen). These currency pairs are also known as minors.

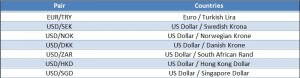

Exotic Currency Pairs

Exotic currency pairs are made up of a major currency paired with the currency of an emerging or a strong but smaller economy from a global perspective such as Hong Kong or Singapore and European countries outside of the Euro Zone.

These pairs are not traded as often as the majors or minors, so often the cost of trading these pairs can be higher than the majors or minors due to the lack of liquidity in these markets.

Reading an FX Quote

As we have already said, when a currency is quoted it is paired with another currency.

So the value of one is reflected through the value of another. The base currency is to the left of the pair and the quote currency is to the right.

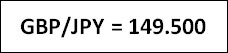

Let’s look at an example:

In this case the Pound Sterling is the base currency and the Japanese Yen is the quote currency.

Therefore: £ 1 = ¥ 149.50

However when we are trading financial instruments such as currencies we are offered two slightly different prices.

1. We have the sell price (also known as the bid price) and the buy price (also known as the ask price).

2. The bid price is the best available price at which we can sell to the market.

3. The ask price is the best available price at which we can buy from the market.

The difference between the two prices is what we call the spread and this is how our broker generates revenue. It is the cost of placing a trade.

In this case we can see the EURUSD has a bid price of 1.31819 and an ask price of 1.31849. The difference between the two is 0.0003 or what we call three pips. In our next article we will discuss the calculation and importance of understanding pips and pip values.